The global pet economy has long been regarded as a resilient sector, but its recent performance has defied even the most optimistic expectations. Amid economic downturns and shifting consumer priorities, spending on pets has not merely held steady—it has surged. The 2025 Pet Economy Consumption White Paper reveals a fascinating trend: pet-related expenditures are growing at an unprecedented rate, outpacing inflation and even eclipsing traditional luxury markets. This phenomenon isn’t confined to a single region; from North America to Asia, households are reallocating discretionary income toward their furry, feathered, or scaled companions. The reasons behind this shift are as complex as they are compelling.

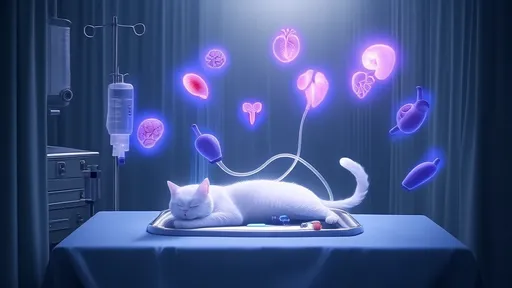

One of the most striking findings of the white paper is the emotional underpinning of this growth. Pets have transitioned from being mere animals to integral family members, a status that justifies higher spending. The bond between humans and their pets has deepened during periods of social isolation, economic uncertainty, and remote work trends. This emotional connection translates into tangible market behaviors: premium pet food sales have skyrocketed, veterinary care is increasingly viewed as non-negotiable, and pet insurance policies are being adopted at record rates. Consumers who might hesitate to splurge on themselves exhibit little restraint when it comes to their pets.

The white paper highlights how innovation is fueling this expansion. Unlike other industries that stagnate during economic slumps, the pet sector thrives on continuous product evolution. From smart collars that monitor a dog’s vitals to subscription-based gourmet cat meals, companies are tapping into pet owners’ willingness to pay for convenience and quality. Technology isn’t just a niche offering—it’s becoming standard. Meanwhile, sustainability has emerged as a major driver, with eco-conscious pet owners demanding biodegradable litter, ethically sourced treats, and carbon-neutral shipping options. These trends aren’t fleeting; they reflect a fundamental reimagining of what pet ownership entails.

Another critical factor is demographic change. Millennials and Gen Z now dominate pet ownership, and their consumption habits differ markedly from previous generations. Younger owners are more likely to prioritize organic ingredients, mental stimulation for pets, and aesthetically pleasing accessories that align with their personal brands. The white paper notes a 40% increase in spending on pet "lifestyle" products—think designer carriers, Instagram-worthy bedding, and artisanal toys—compared to pre-pandemic levels. This demographic isn’t just buying necessities; they’re curating an entire experience around pet parenthood, blurring the lines between pet care and self-expression.

Perhaps the most unexpected revelation is the role of emerging markets in this growth story. While the U.S. and Europe remain dominant, countries like China and Brazil are seeing explosive demand for premium pet services. The white paper documents a 200% rise in pet grooming salons in Shanghai alone over the past three years, alongside a boom in pet-friendly cafes and hotels. Urbanization and rising disposable incomes are creating a new class of pet owners who view lavish spending on animals as a symbol of modernity. This globalization of pet luxury suggests that the industry’s growth trajectory is far from plateauing.

What does this mean for investors and businesses? The white paper argues that the pet economy’s resilience makes it a rare bright spot in an otherwise volatile market. However, success requires more than just jumping on the bandwagon. Companies must understand the nuanced expectations of today’s pet owners: they want ethical sourcing, personalized services, and seamless digital integration. Brands that treat pets as sentient family members rather than property will capture the lion’s share of this expanding market. As the 2025 data makes clear, the humanization of pets isn’t a trend—it’s a permanent transformation reshaping consumer behavior worldwide.

The implications extend beyond commerce. Policymakers are beginning to grapple with how this shift affects housing regulations, public spaces, and even workplace norms. The white paper cites examples of cities redesigning parks to accommodate off-leash zones and corporations adding pet benefits to employee packages. As pets assume greater centrality in daily life, their economic influence will inevitably spark broader societal changes. One thing is certain: the era of treating the pet industry as a trivial or niche market is over. The 2025 Pet Economy Consumption White Paper doesn’t just document numbers—it captures a cultural revolution, one paw print at a time.

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025

By /Jul 7, 2025